Indianapolis Heating and Cooling Blog

The Hidden ROI of HVAC Maintenance

There’s a certain satisfaction in solving a problem by addressing it directly. But if there’s one thing I’ve learned over the years, it’s that the most effective solutions often appear long before the problem itself does. In business and in life, addressing an issue before it grows into a costly emergency isn’t glamorous—but it’s essential....

Read More →

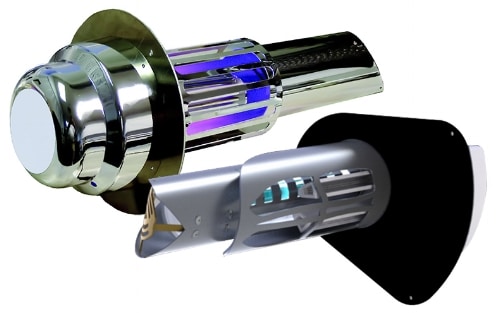

Reme Halo Review: Helping to Deliver Air Health in Indianapolis

Reme Halo Helps Indianapolis Homeowners Tackle Indoor Air Quality Issues October means the end of summer and the first signs of fall. With snow on its way, temperatures getting cooler, and fall allergies in full force, it means air quality and indoor air health challenges in Indianapolis homes change. For Indianapolis area homeowners our favorite...

Read More →

IAQ (indoor air quality) is an important part of your home’s health

IAQ (indoor air quality) is an increasingly hot topic as homeowners consider the health of their home. Many people are also spending more time working from home in recent years. This means making the home safe and healthy is top of mind for everyone. While it’s showing up in the news and culture...

Read More →

The Homesense Tune-Up Process

Like any mechanical system, your HVAC system breaks down over time and needs consistent tune-ups. A tune-up, like an oil change for your car, can help ensure that your systems run longer and smoother. This saves you time, money, and (hopefully) stress. As we’ve outlined in our comprehensive Maintenance Guide, getting seasonal tune-ups on your...

Read More →

iWave Air Purifier Review: indoor air quality made easy

We’re officially heading towards fall here in Indianapolis. As a result, that means cooler temperatures and the start of fall allergies for many homeowners. As we’ve all spent more time indoors the past year and a half, indoor air quality has become a more important subject for many people. The EPA says indoor air is...

Read More →

Are HVAC Service Agreements Worth It? Exploring the Value of Annual Service Plans

As a homeowner in Indianapolis, maintaining your HVAC system is essential to ensuring year-round comfort. One question that often comes up is whether annual HVAC service agreements are worth the investment or just a clever way for companies to make extra money. From what you see on Facebook groups and other discussions online, it makes...

Read More →

Most Commonly Asked HVAC Questions – Answered!

We’ve been doing HVAC for a while now in and around Indianapolis and we get a lot of questions from customers related to their homes and systems. In an effort to bring all that expertise together, we’ve compiled a list of some of the most common questions our techs get asked every year as the...

Read More →

Why our technicians aren’t incentivized to sell

“It’s time to replace your AC (or furnace).” Maybe you’ve had an HVAC technician say this to you before with utmost certainty. Seems harmless enough, right? Sometimes it’s true, but would you trust a cardiologist who only gave you the option to have a heart transplant? Similarly, would you trust a technician that’s incentivized to...

Read More →

Dehumidifiers 101: What do they do and why do I need one?

Humidity Problem Living in the midwest means we’re all familiar with humidity, but many homeowners aren’t familiar with how to control humidity through dehumidifiers. Few things are worse than stepping outside on a July day and feeling the hot wall of humidity hit you. While the summer especially comes to mind, the outside air is...

Read More →

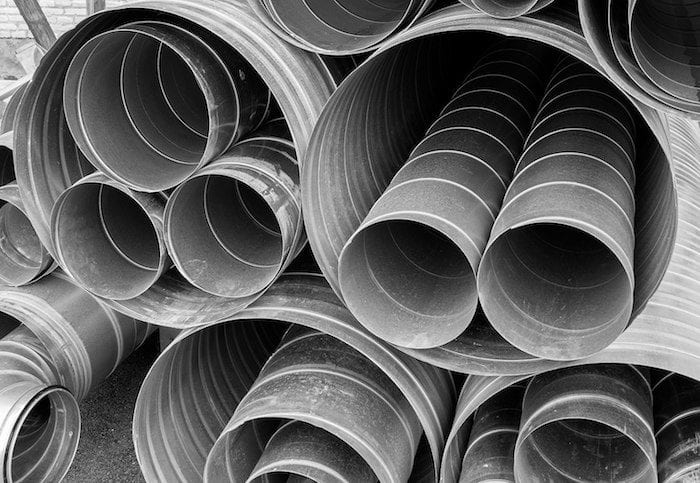

The Most Common Air Duct Problems for Homeowners

Air ducts work in the background to keep your home heated and cooled properly and to maintain good indoor air quality. When your HVAC system and ductwork are functioning properly, air flows smoothly. When they are not, you may know it by some common signs: Rising energy bills Rooms that are difficult to heat and...

Read More →