Indiana HVAC Utility Rebates For 2023

If you are looking to upgrade your HVAC (heating, ventilation, and air conditioning) system in Indiana, now may be the time to do it. There are several utility companies in Indiana offering rebates for upgrading to energy-efficient HVAC systems in 2023.

Indiana HVAC Rebates

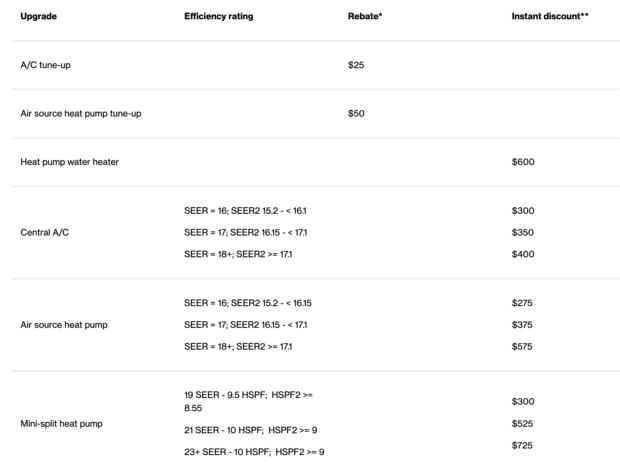

AES Rebates

One of the largest utility companies in Indiana offering HVAC rebates is AES. AES is offering rebates for customers who upgrade to a high-efficiency air conditioner, heat pump or mini split. The rebates vary based on the type and efficiency of the system, with a maximum rebate of $725 available for the most efficient systems.

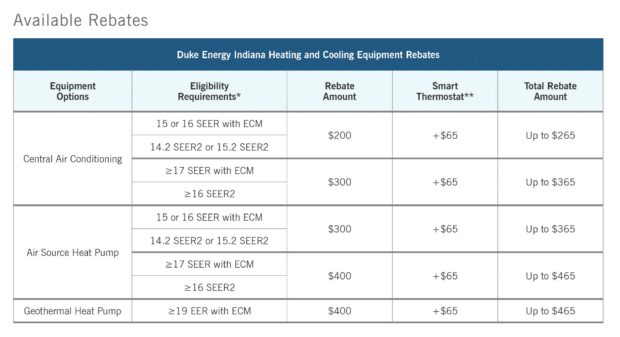

Duke Energy HVAC Rebates

Another large central Indiana utility company is Duke Energy. Duke’s Smart Saver program has been around a few years, and continues to grow in it’s number of energy efficiency incentives. For a qualifying system, homeowners can receive up to a $465 in rebate.

Centerpoint HVAC Rebates

Centerpoint (formerly Vectren) offers a variety of rebates for replacement heat pumps and air conditioners, to tune-ups on those systems. The variety of Centerpoint HVAC Rebates can be found by checking that link.

NIPSCO HVAC Rebates

Another utility company in Indiana offering HVAC rebates is Northern Indiana Public Service Company (NIPSCO). NIPSCO is offering rebates for customers who upgrade to a high-efficiency air conditioner, heat pump, or furnace. The rebates vary based on the type and efficiency of the system, with a maximum rebate of $400 available for the most efficient systems.

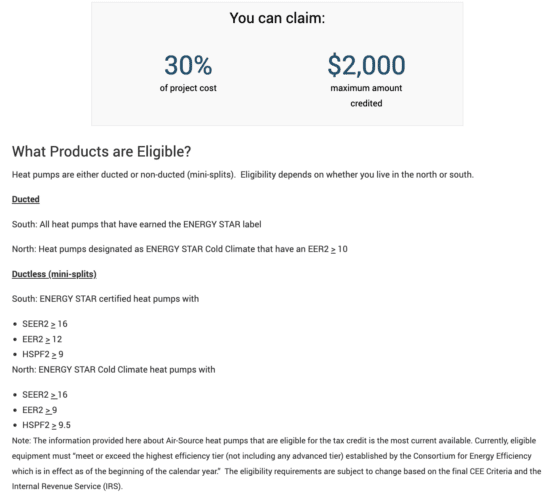

Federal Tax Credits for Energy Star Qualified HVAC Replacements

Federal Tax Credits have grown in 2023 with language from the Federal “Inflation Reduction Act”. Most notably, qualifying heat pumps are eligible for up to a $2,000 tax credit. It doesn’t end there, with Air Conditioning replacements and other HVAC systems also qualifying.

Check the available rebates in your zip code, by using the Energy Star Rebate Finder

Various Ways To Qualify For Rebates

Replacing your system is not the only way to qualify for rebates. Things such as A/C Tune-ups, Air source heat pump tune-up, New A/C, Mini splits and Attic insulation also qualify for rebates. Some are instant discounts and some are rebates.

In addition to the rebates offered by these utility companies, there may be additional rebates available through local and state programs. For example, the Energy Efficient Indiana program offers rebates for customers who upgrade to energy-efficient HVAC systems, as well as other energy-efficient appliances and technologies.

To take advantage of the HVAC system rebates offered by Indiana utility companies, it is important to work with a licensed contractor who can help you select a system that meets the eligibility requirements for the rebate. The team at Homesense Heating & Cooling can help with both the rebates and a seamless installation.

The rebates offered by utility companies can help offset the cost of purchasing and installing a new system and can lead to long-term savings on energy bills. To take advantage of these rebates, scan QR code below and schedule a Free In Home Estimate.